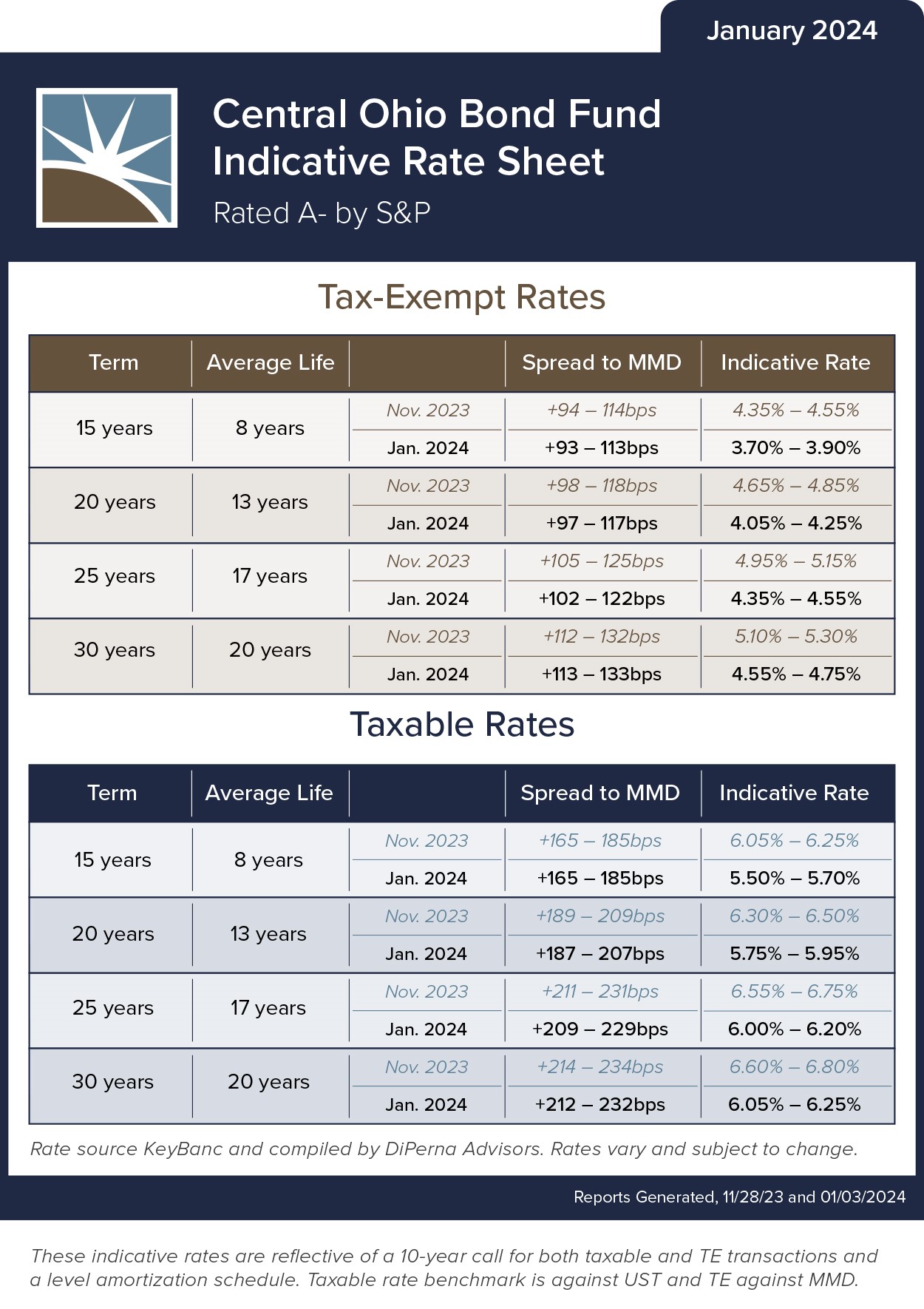

Last year we began sharing a monthly rate sheet for our Central Ohio Regional Bond Fund. As the calendar flips to 2024, we see encouraging activity: dropping rates.

One expert CFFA works with sees this as a positive trend, which could be influenced by the 2024 presidential election. “Rates made a round trip in 2023,” says Brian Sharnsky, Director, Public Finance with KeyBanc Capital Markets. “They rose by over 100 basis points across the curve to highs in late October, before coming back down by over 100 basis points by the end of December to levels near or below where they spent the first half of the year.”

Sharnsky continues, “The late Q4 rally was sparked by positive news on inflation and Fed signals for rate cuts in 2024, with current consensus being that the Fed will be cutting rates between 75 basis points and 150 basis points, which could start as soon as March. Looking further ahead in 2024, in addition to anything that might affect the Fed’s interest rate policy, markets will be focused on the impending U.S. presidential election in November.”

Sharnsky believes many topics will be of interest leading up to the 2024 election, including the expiration of the 2017 tax cuts, the federal deficit, inflation, and domestic energy policies. “For the municipal bond markets,” he says, “ elimination of the 2017 tax cuts could meaningfully increase demand for tax-exempt income, resulting in a further reduction of tax-exempt investments.”

We anticipate bond activity in 2024 with issuances from both our bond fund and conduit Private Activity Bonds, which help finance nonprofits, affordable housing, healthcare, and education.